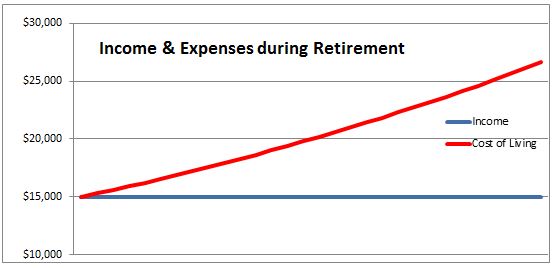

In our previous article, we looked at how seniors generally wish to invest their money to feel safe while in reality their expenses rise throughout their retirement years as the cost of various services, such as hydro and property taxes, typically increase annually. ( See graph at bottom )

Your choices are to either decrease your spending or deplete your savings or some combination of the two in order to make ends meet. The challenge is to make sure you don’t run out of money before you run of time!

Reducing expenses can include downsizing one’s home, cutting out vacations, reducing gifts to grandchildren and eating cheaper cuts of meat amongst many options. But there will be a limit to how much you can realistically reduce expenses.

Can this be a problem for you in retirement? When you are building your savings financial advisors often refer to the Rule of 72. This calculates how much time it will take to double your money given a fixed annual rate of return. A 7% return will allow you to double your money in approximately ten years while a 10% return will double your money in approximately seven years.

The Rule of 114 is the calculation used to figure out how many years it will take for the cost of something to triple. With many retirements now lasting as long as or longer than people’s working years, this is a realistic risk.

At a 4% annual inflation rate, which is roughly, the 50-year average since WW II, it takes 29.5 years for expenses to triple. At 6% it takes 19 years for them to triple. So it is realistic to expect and plan for your costs to triple in your retirement years.

Some people may argue that inflation is currently running below 2%. This would therefore reduce the risk of a tripling in living expenses substantially. Maybe, but a doubling will still be a challenge if you are fully invested in fixed income strategies. The issue is the loss of purchasing power over time and the need for a rising income to protect your standard of living. Otherwise you are going broke slowly!

Which also raises the question of what is the real inflation rate in Canada? The Bank of Canada tends to exclude volatile CPI components? in order to smooth out inflation numbers thereby lowering the true reported cost of living. The Bank of Canada describes this as follows:

Core? consumer price index (CPIX):This measure strips out eight of the most volatile CPI components (fruit, vegetables, gasoline, fuel oil, natural gas, mortgage interest, intercity transportation, and tobacco products), as well as the effect of changes in indirect taxes on the remaining components. The Bank also monitors other measures of underlying (core?) inflation.

http://www.bankofcanada.ca/rates/indicators/key-variables/inflation-control-target/

Notice that many of the items are for goods that you need for daily living! Thus, it is hard to believe that inflation is less than 2% when many government fees are rising higher than 2%. Canada Post recently hiked stamps 20% – 30%. Rising property taxes and Ontario’s hydro rates are rising 5% or more for the foreseeable future are other examples. Retirees also need to consider the rising cost of medicines and health care as they age.

The question is: Does your investment strategy include a strategy to offset the rising cost of living during your retirement years?

Call us today to discuss the options we can provide to protect you against the rising cost of living in your retirement years.

Questions about your retirement planning ?

Contact our office today !

Copyright © 2014 AdvisorNet Communications Inc., under license from W.F.I. All rights reserved. This article is provided for informational purposes only and is not intended to provide specific financial advice. It is strongly recommended that the reader seek qualified professional advice before making any financial decisions based on anything discussed in this article. This article is not to be copied or republished in any format for any reason without the written permission of AdvisorNet Communications. The publisher does not guarantee the accuracy of the information and is not liable in any way for any error or omission.